To generate leads for your accountancy practice, you need to get plenty of prospects into your marketing funnel.

That bit of jargon is part of every salesperson’s vocabulary but might sound a bit alien if that’s not your territory.

This week our commerical manager, Yvette Culbert and account director, Alex Tucker explore why your accountancy practice needs to focus on its marketing funnel at the different stages.

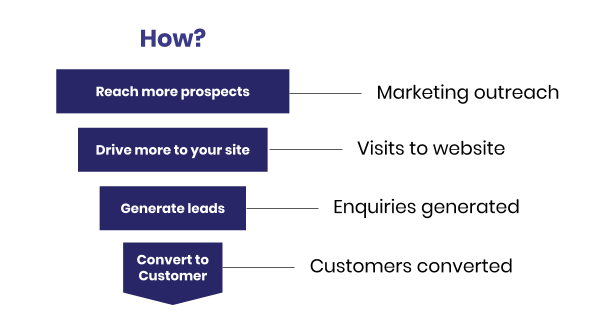

The marketing funnel refers to all of the sales leads or prospects within your marketing programme, and hopefully in your CRM system, at various stages of the buying process.

The stages that a prospect will go through are, broadly:

- awareness

- interest

- evaluation

- commitment

- purchase

You might also hear sales and marketing people refer to these stages as:

- marketing qualified lead

- sales qualified lead

- opportunity

- proposal

- sale

But why ‘funnel’?

Invariably prospects will drop off at each stage of the buying process, as they find their own solutions or choose alternatives to your service.

So, if we visualise the prospects remaining in your marketing system at each stage of the process it would look roughly like a funnel, narrowing towards the bottom.

Marketers often further simplify this model by referring to the stages as top, middle and bottom of the funnel.

Prospects at the top of the funnel are speculative – they might work out, they might not.

Those at the bottom of the funnel are pretty close to being ready to make a purchase and getting them over the line is where the majority of your sales team’s effort will go.

What are conversion rates?

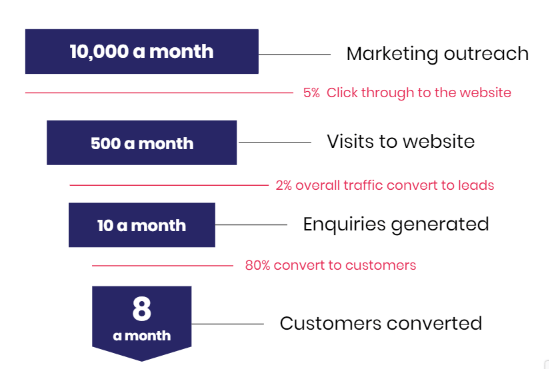

Conversion rate refers to the percentage of prospects which are successfully moved from one stage of the process to another. For example, if you generate a hundred leads and five of these lead to opportunities then your conversion rate for this part of the process is 5%.

Why do conversion rates matter? Because they can help you pinpoint weak spots in your marketing programme and are therefore really important in understanding the effectiveness of your sales and marketing activity.

In other words, they’re a key measure for the return on investment your marketing is providing.

What does good look like?

Conversion rates will vary quite a lot between different businesses with different approaches and a lot will depend on the resources available to you and the systems and processes you have in place.

On average, a good conversion rate for a website enquiry on an accounting website, based on an analysis of sites hosted on our own Horizon platform, is anything above about 6%.

The average is more like 2% and the highest performing sites – those with a sophisticated approach to SEO and lots of quality content – achieve up to 9%.

It’s important to measure what you are achieving now and focus on what you can do to improve each stage in line with your firm’s goals.

How accountants can improve conversion rates

There are a number of ways visitors to an accounting firms website might convert to leads or prospects. Some of these are relatively simple and will lead to sales more quickly – they might email you, call you, or fill in an enquiry form.

Some will require a bit more nurturing – for example, they might fill in a form to download a whitepaper or eBook, or sign up for a webinar.

If an accounting firm has a large volume of website visitors but isn’t generating many sales leads, the key areas to explore will be the design and content of the site.

- Does the site have forms in all the right places?

- Is it easy enough for prospects to get in touch?

- Are you communicating your value proposition in a compelling way?

- Do you have some high value content which visitors can download in exchange for their contact details?

All of these things will help improve conversion rates to bring leads into the top of the funnel.

Measuring the top of the funnel

Google Analytics will be the key tool for most accountants seeking to understand what’s happening at the top of the marketing funnel.

Make sure you have goals and conversions set up in your account. You might want some help with this as it’s a fairly technical task but once it’s set up, it makes life a lot easier thereafter.

If you want to get a bit more advanced, you can even track which media or campaigns are leading to the highest volume of conversions

Into the middle of the funnel

For lots of accountancy firms, converting leads in the middle of the funnel will involve a mix of email marketing and sales activity.

Try some of these tactics to help create opportunities:

- Email some content which teaches them something they don’t know about their business and follow up with a call to discuss the possible impact of this to them.

- Send them a detailed case study showing how a client in their sector has benefited from your accountancy services.

- Once they have engaged with these activities they may be qualified enough to offer a free consultation.

If a prospect does not convert to an opportunity at this stage, keep them in your marketing database and continue to send them content which will be useful to them – whitepapers and webinars can be particularly useful – and call them again once you can see that they have engaged more with your marketing.

Your email marketing system should give you detailed data on who has opened and clicked links within your email campaigns.

You can use this information to help understand which prospects should be nurtured and which are ready for a commercial conversation about your services.

If a prospect does not convert to an opportunity at this stage, keep them in your marketing database and continue to send them content which will be useful to them – whitepapers and webinars can be particularly useful – and call them again once you can see that they have engaged more with your marketing.

Your email marketing system should give you detailed data on who has opened and clicked links within your email campaigns.

You can use this information to help understand which prospects should be nurtured and which are ready for a commercial conversation about your services.

Conversion to sale – bottom of the funnel

Getting opportunities across the line is where accountants’ sales skills come in. It’s not all down to your wit and charm though – here are some other factors to consider:

- How well does your proposal documentation work?

- If there are multiple decision makers, are you providing the right content for your contact to get their buy-in?

- Is the timing of your follow up working well? Too quick and you can come across as pushy, too slow and your competitor could steal the march.

Your customer relationship management (CRM) system is vital for measuring the bottom of the funnel.

It should help you keep track of individual opportunities and the actions required to close them, as well as giving you useful data on your conversion rates, the value of opportunities and how long they take to close.

The takeaway

Visualising your marketing funnel can be a good way to understand where your prospect is on their buyer journey and to make sure you’re providing them with the right marketing content and having the right conversations to get them to the next stage.

It’s also valuable in diagnosing any potential flaws or blind spots in your sales and marketing efforts.

If you do nothing else, take steps now to get your Google Analytics set up with goals and conversions.

Get in touch to talk about generating leads and measuring marketing activity ROI or have a look at our complete guide to lead generation for accountants.

Like and share using the buttons below